Why become a SAFE member?

When you become a member of SAFE, you’re part of something bigger than a credit union. You’re joining a family of 140,000 members in South Carolina and beyond who are saving money, building financial freedom, and achieving their dreams.

- Higher dividends on savings, lower interest rates on loans, fewer fees, and more

- Service from employees who treat you like family

- Meaningful engagement in your community like shred events, food drives, clean-up efforts, and bringing Christmas cheer to our neighbors in need

Am I eligible to be a member?

Check Eligibility by Location

We serve a seven-county region in South Carolina—including Clarendon, Florence, Lee, Sumter, and parts of Lexington, Richland, and Kershaw counties. Depending on where you live, work, worship, or go to school, you may already be eligible for SAFE membership! Retired service members in all branches of the armed forces are automatically eligible, too!

Check Eligibility by Organization

You also are eligible to become a member if your employer, place of worship, or other association is one of the 400+ organizations with Select Employee Group (SEG) status. If your location doesn’t already qualify you for membership with SAFE, check here!

The SAFE Difference

What's the difference between a bank and a credit union?

Unlike big banks, SAFE is not looking to make profits for a bunch of corporate owners. That's why we can offer lower interest rates on loans and higher yields on deposits—all with none of the aggravating fees and monthly expenses that can come with big banks.

We Take Time to Get to Know You

When you join SAFE, you're joining more than just a financial institution. You're joining our family. We take time to get to know you—to answer your questions, find tailored solutions, and help you navigate your finances through all stages of life.

We offer educational tools to help with the important things like how to Improve your financial situation, homebuying, credit scores, fraud trends, retirement, and more. We believe our success only happens when you're financially successful, too. You won't find that at a corporate bank.

Credit Union FAQs

Credit unions are not-for-profit, membership-based, cooperative financial institutions. We exist to promote the financial well-being of their members by offering competitive products with better rates and fees than traditional for-profit institutions.

In our case, SAFE was formed in 1955 by a group of civic-minded civilian employees at Shaw Air Force Base. In fact, our name comes from their collaboration: Shaw Air Force Employees (SAFE) Federal Credit Union!

Credit unions offer most of the same products and services you’ll find at many banks. Common credit union offerings include checking and savings accounts, mobile banking, mortgages, and a wide range of consumer loans such as those for cars, trucks, boats, RVs, and more. Generally speaking, credit unions provide more attractive rates than banks on their deposit accounts and loans.

But unlike banks, credit unions are:

- Member-owned: Credit union members are more than just customers, and have a vote in electing a volunteer board of directors

- Not-for-profit: Profits are returned to members in the form of lower fees and higher savings rates. In SAFE’s case, this also includes returning a portion of its net revenue in the form of an annual giveback. It’s our way of thanking members for our success.

- Cooperative: One member’s deposit provides the funds to help finance another member’s loan, creating a cycle of mutual assistance that contributes to the financial well-being of all members

Locally, SAFE operates 19 branches across the Midlands of South Carolina as well as a wide selection of ATMs. Members can also access our Personal Teller Machines (PTMs), which provide face-to-face video access to our tellers and extended banking hours.

With SAFE, though, you’re never far from a branch or an ATM – even if you’re all the way across the country. SAFE is a member of the CO-OP Shared Branch NetworkSM, which gives our members access to more than 5,000 credit union locations (and over 30,000 different ATMs) nationwide.

Thanks to shared branching, you can use the branches of many distant credit unions as if you were in your own neighborhood. No surcharges. No access fees. No hassles!

Each credit union has a “field of membership” that determines who is eligible to join.

At SAFE, eligibility for membership in our credit union can be determined by:

- Geographic location—We serve a seven-county area in the Midlands of South Carolina. See if you qualify by location.

- Employer or membership in a group—If your employer, place of worship, or another association is one of our membership partners, you may be eligible to join SAFE. Check our Select Employee Groups list.

- Membership status of your relatives—If one of your immediate family members is a SAFE member, you may be eligible to join, too.

Military Savings Program

Active-duty members of the U.S. armed forces, as well as called-to-duty National Guard members and reservists, can take advantage of our Mission: SAFEkeeping Program. Benefits include:

- Personalized financial advice sessions

- Flexible terms for loan repayment

- Preferred-rate emergency loans

Shared Branching

As a member of the CO-OP Shared Branch NetworkSM, our cardholders are allowed complimentary access to more than 5,000 different credit union locations (and over 30,000 different ATMs) nationwide. No surcharges. No access fees. No hassles!

With your SAFE member number and a valid photo ID, you can do the following at our partnering credit union locations:

- Purchase money orders and official checks

- Transfer funds between accounts

- Make loan payments

- Make withdrawals and deposits

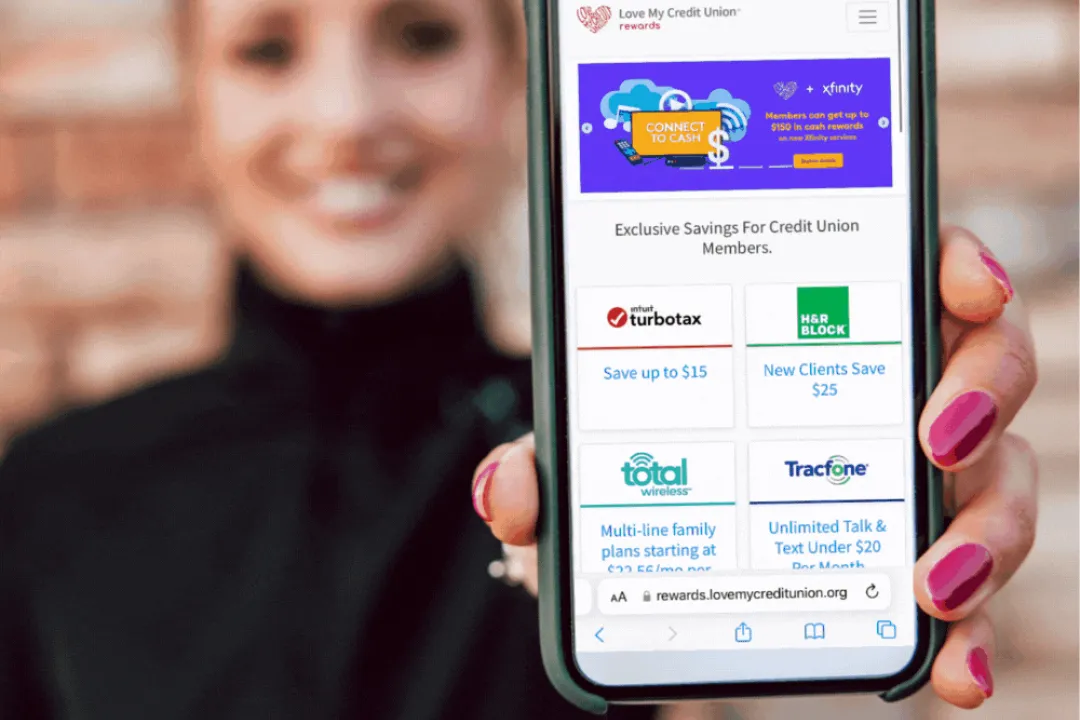

Special Credit Union Discounts

Love My Credit Union Rewards® offer a range of special discounts for credit union members. Visit the Love My Credit Union Rewards® website to learn more about the discount options available for members.